|

Healthcare related to multiple sclerosis (MS) can be a major financial drain even when you have good insurance. No matter how you get your health coverage, make sure that you know the basic facts about the eligibility rules for your health plan. Without that knowledge, your healthcare costs could be higher than they need to be.

The Patient Protection and Affordable Care Act (ACA) was signed into law in 2010. This complex legislation — which is scheduled to take effect over a ten-year period — outlines major changes in federal and state laws that will reform the health insurance system. |

Click on the "Download File" in blue below for information about the ACA from the MSAA.

| ||||||

|

However, the ACA is facing numerous legal challenges at this time, which means that knowing exactly what kinds of changes will take place and when they might occur is impossible. So make sure you get expert advice before making any major decisions about your health insurance coverage. Go to the government's health insurance information website for reliable and detailed information about health coverage in your state.

|

Here is a report (see financial wellness survey report below and click on 'download file' about the financial wellness of people with MS):

| ||||||

And here is an organization that has a coaching program for people with MS. You can contact them and ask to speak with a financial coach: http://www.realeconomicimpact.org/REI-Network.aspx

The REI-Network also has free financial webinars: http://www.realeconomicimpact.org/Financial-Education/Financial-Wellness-Webinar-Series.aspx

Employment-based insurance programs

Most people in the United States have health insurance because they’re eligible for a group health plan from their employer or a family member’s employer. Members of trade unions (and their dependents) are usually eligible for group coverage through the union.

If you’re eligible for group health benefits from an employer or union, enroll as soon as possible. In most cases, you’ll pay a small portion of the premium through a regular payroll deduction, and your employer will pay the balance. Even if you don’t enroll in the health plan until after your MS diagnosis, you’re still eligible. Federal law guarantees that no one can be singled out and denied group health benefits on the basis of his or her health status.

If your company offers a long-term disability benefit, take them up on it (after you’ve reviewed the definition of disabled that’s being used by the plan — the definition tends to be very specific and very strict). This kind of insurance can go a long way in keeping you afloat longer term if you’re no longer able to work.

Most people in the United States have health insurance because they’re eligible for a group health plan from their employer or a family member’s employer. Members of trade unions (and their dependents) are usually eligible for group coverage through the union.

If you’re eligible for group health benefits from an employer or union, enroll as soon as possible. In most cases, you’ll pay a small portion of the premium through a regular payroll deduction, and your employer will pay the balance. Even if you don’t enroll in the health plan until after your MS diagnosis, you’re still eligible. Federal law guarantees that no one can be singled out and denied group health benefits on the basis of his or her health status.

If your company offers a long-term disability benefit, take them up on it (after you’ve reviewed the definition of disabled that’s being used by the plan — the definition tends to be very specific and very strict). This kind of insurance can go a long way in keeping you afloat longer term if you’re no longer able to work.

Public health insurance programs

Many people are covered by a government-funded, public health insurance program because they meet the established eligibility criteria. The public health insurance programs listed here are designed for people who work for the military or the government, and for those who don’t have access to other coverage because of unemployment, age, income level.

Many people are covered by a government-funded, public health insurance program because they meet the established eligibility criteria. The public health insurance programs listed here are designed for people who work for the military or the government, and for those who don’t have access to other coverage because of unemployment, age, income level.

- Government employee benefits: Federal government employees can enroll in the Federal Employee Health Benefits Program (FEHBP). State and municipal employees are offered comparable programs.

- Medicare is a government entitlement program that provides health coverage for people who qualify. To be eligible for Medicare, you must meet one of the following requirements: You must be at least 65 years old and you must have been deemed “disabled” by the Social Security Administration (SSA) for at least 24 months.

- Medicaid is a government entitlement program that provides health insurance for low-income people. Medicaid eligibility rules are scheduled to change with the new federal law in 2014, but until then you must meet the specific criteria determined by your state government. Although the states vary considerably, eligibility is based on your income, your assets, and your marital and immigration status.

- SSDI: If you’re no longer able to work because of your MS, you may qualify for Social Security Disability Insurance (SSDI) or other long-term disability programs.

- State Child Health Insurance Programs (S-CHIPs) are public insurance programs that provide coverage to children 18 and under, with income eligibility benefits determined by each state.

- TRICARE is a program that provides benefits for people in the uniformed services (Active, Reserve, and Guard) and their dependents.

- VA health benefits are provided by the Veterans Administration to people who have been honorably discharged from active military service.

- For small businesses, employers and employees, click here: https://www.healthcare.gov/small-businesses/

How to find out if you're eligible for Medicaid or CHIP (Children's Health Insurance Program)

These programs cover millions of individuals and families with limited incomes and disabilities. If you qualify, you can enroll any time.

1. Medicare PART A http://www.medicare.gov/what-medicare-covers/part-a/what-part-a-covers.html

Part A covers:

You can even type in the service or lab to see if it is covered here into an easy search box:

http://www.medicare.gov/coverage/your-medicare-coverage.html

2. Medicare Part B covers things like:

Two ways to find out if Medicare covers what you need

You can locate suppliers covered by Medicare with a zip code search here: http://www.medicare.gov/supplierdirectory/search.html

3. Medicare Part D

Each Medicare Prescription Drug Plan has its own list of covered drugs (called a formulary). Many Medicare drug plans place drugs into different "tiers" on their formularies. Drugs in each tier have a different cost.

http://www.medicare.gov/part-d/index.html

4. Medi-gap Insurance

A Medicare Supplement Insurance (Medigap) policy, sold by private companies, can help pay some of the health care costs that Original Medicare doesn't cover, like copayments, coinsurance, and deductibles.

Some Medigap policies also offer coverage for services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

You must have Medicare Part A and Part B.

If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

5. SSI (Social Security Insurance) and SSDI (Social Security Disability Insurance)

Navigating the maze can be difficult, with a high percentage of rejects. A search for "SSI and SSDI advocates" and zip code will locate those who can help with the process.

6. CHIP (children's health insurance program)

https://www.healthcare.gov/medicaid-chip/childrens-health-insurance-program/

These programs cover millions of individuals and families with limited incomes and disabilities. If you qualify, you can enroll any time.

1. Medicare PART A http://www.medicare.gov/what-medicare-covers/part-a/what-part-a-covers.html

Part A covers:

- Hospital care

- Skilled nursing facility care

- Nursing home care (as long as custodial care isn't the only care you need)

- Hospice

- Home health services

You can even type in the service or lab to see if it is covered here into an easy search box:

http://www.medicare.gov/coverage/your-medicare-coverage.html

2. Medicare Part B covers things like:

- Clinical research

- Ambulance services

- Durable medical equipment (DME)

- Mental health

- Getting a second opinion before surgery

- Limited outpatient prescription drugs

Two ways to find out if Medicare covers what you need

- Talk to your doctor or other health care provider about why you need certain services or supplies, and ask if Medicare will cover them. If you need something that's usually covered and your provider thinks that Medicare won't cover it in your situation, you'll have to read and sign a notice saying that you may have to pay for the item, service, or supply.

- Find out if Medicare covers your item, service, or supply.

You can locate suppliers covered by Medicare with a zip code search here: http://www.medicare.gov/supplierdirectory/search.html

3. Medicare Part D

Each Medicare Prescription Drug Plan has its own list of covered drugs (called a formulary). Many Medicare drug plans place drugs into different "tiers" on their formularies. Drugs in each tier have a different cost.

http://www.medicare.gov/part-d/index.html

4. Medi-gap Insurance

A Medicare Supplement Insurance (Medigap) policy, sold by private companies, can help pay some of the health care costs that Original Medicare doesn't cover, like copayments, coinsurance, and deductibles.

Some Medigap policies also offer coverage for services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

You must have Medicare Part A and Part B.

If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

5. SSI (Social Security Insurance) and SSDI (Social Security Disability Insurance)

Navigating the maze can be difficult, with a high percentage of rejects. A search for "SSI and SSDI advocates" and zip code will locate those who can help with the process.

6. CHIP (children's health insurance program)

https://www.healthcare.gov/medicaid-chip/childrens-health-insurance-program/

Health Insurance Supplementals

Prescription Discount Cards

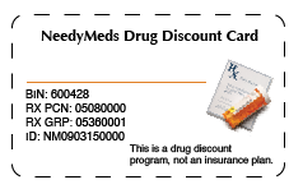

If you DON'T have insurance that pays for prescriptions and are paying CASH, you might be able to benefit from prescription discount cards (see example of a NeedyMeds drug discount card below). Please note that this is not an insurance card and note that some of these card programs SELL your personal information (NeedyMeds does not but many of these types of cards do), so make sure you check to be sure you use a card that is not selling your personal information.

NeedyMeds is a 501(c)(3) national non-profit information resource dedicated to helping people locate assistance programs to help them afford their medications and other healthcare costs. Here is a video explaining their prescription discount cards, which are for people that pay cash for their medications.

Prescription Discount Cards

If you DON'T have insurance that pays for prescriptions and are paying CASH, you might be able to benefit from prescription discount cards (see example of a NeedyMeds drug discount card below). Please note that this is not an insurance card and note that some of these card programs SELL your personal information (NeedyMeds does not but many of these types of cards do), so make sure you check to be sure you use a card that is not selling your personal information.

NeedyMeds is a 501(c)(3) national non-profit information resource dedicated to helping people locate assistance programs to help them afford their medications and other healthcare costs. Here is a video explaining their prescription discount cards, which are for people that pay cash for their medications.

Don't have insurance? Here's how to get it:

Open enrollment for 2015 started back in fall of 2014 and ended Feb 15.

So, that means now, in order to get insurance:

1) Find out if you qualify for a Special Enrollment Period. Have all personal information readily available. This handbook outlines the information you will need. https://marketplace.cms.gov/outreach-and-education/apply-for-or-renew-coverage.pdf

The below individuals' information will be required. Once information is collected, you can proceed to see if you qualify and can enroll in a Marketplace health plan outside the annual Open Enrollment. Fill out the marketplace application here: www.healthcare.gov/screener

Your Marketplace application will ask you about each person in your household.

For the Marketplace, your household usually includes the tax filers and their tax dependents, but there are exceptions. Sometimes the Marketplace includes people you live with who aren’t in your tax household.

You should include yourself on your application. Here’s a basic list of the other people you should generally include, if these apply to you:

Open enrollment for 2015 started back in fall of 2014 and ended Feb 15.

So, that means now, in order to get insurance:

1) Find out if you qualify for a Special Enrollment Period. Have all personal information readily available. This handbook outlines the information you will need. https://marketplace.cms.gov/outreach-and-education/apply-for-or-renew-coverage.pdf

The below individuals' information will be required. Once information is collected, you can proceed to see if you qualify and can enroll in a Marketplace health plan outside the annual Open Enrollment. Fill out the marketplace application here: www.healthcare.gov/screener

Your Marketplace application will ask you about each person in your household.

For the Marketplace, your household usually includes the tax filers and their tax dependents, but there are exceptions. Sometimes the Marketplace includes people you live with who aren’t in your tax household.

You should include yourself on your application. Here’s a basic list of the other people you should generally include, if these apply to you:

- Your spouse

- Your children who live with you, even if they make enough money to file a tax return themselves

- Anyone you include on your tax return as a dependent, even if they don’t live with you

- Anyone else under 21 who you take care of and who lives with you

- Your unmarried partner, only if one or both of these apply

Click on the links below for more information on healthcare costs/options and MS